All Categories

Featured

Table of Contents

The method has its own advantages, yet it additionally has concerns with high costs, intricacy, and a lot more, causing it being regarded as a rip-off by some. Unlimited banking is not the most effective policy if you require just the financial investment component. The unlimited banking concept revolves around the usage of entire life insurance policy plans as a monetary device.

A PUAR permits you to "overfund" your insurance plan right as much as line of it coming to be a Modified Endowment Agreement (MEC). When you make use of a PUAR, you quickly enhance your money worth (and your survivor benefit), therefore enhancing the power of your "bank". Even more, the more cash money worth you have, the better your interest and reward payments from your insurance provider will be.

With the increase of TikTok as an information-sharing system, monetary guidance and approaches have actually discovered an unique means of dispersing. One such technique that has been making the rounds is the infinite banking idea, or IBC for brief, gathering recommendations from celebs like rap artist Waka Flocka Fire - Infinite Banking cash flow. Nonetheless, while the method is presently popular, its origins map back to the 1980s when financial expert Nelson Nash presented it to the globe.

Is there a way to automate Wealth Management With Infinite Banking transactions?

Within these policies, the cash worth expands based on a rate established by the insurance provider. Once a significant cash money worth collects, insurance holders can obtain a cash worth loan. These lendings vary from conventional ones, with life insurance policy functioning as security, meaning one could lose their coverage if borrowing excessively without sufficient cash money worth to support the insurance coverage expenses.

And while the allure of these policies is obvious, there are inherent limitations and threats, demanding persistent cash money worth tracking. The technique's authenticity isn't black and white. For high-net-worth individuals or local business owner, especially those making use of techniques like company-owned life insurance policy (COLI), the advantages of tax breaks and compound growth can be appealing.

The appeal of unlimited financial does not negate its obstacles: Cost: The fundamental requirement, an irreversible life insurance coverage policy, is pricier than its term counterparts. Qualification: Not everyone receives entire life insurance policy as a result of rigorous underwriting procedures that can omit those with details health and wellness or way of living problems. Intricacy and threat: The detailed nature of IBC, paired with its dangers, may discourage several, particularly when easier and less dangerous alternatives are offered.

What is the best way to integrate Infinite Banking Cash Flow into my retirement strategy?

Allocating around 10% of your monthly earnings to the policy is simply not practical for lots of people. Utilizing life insurance policy as an investment and liquidity resource needs technique and tracking of policy cash value. Get in touch with a monetary expert to figure out if boundless financial aligns with your priorities. Component of what you read below is simply a reiteration of what has currently been claimed over.

So prior to you obtain into a situation you're not gotten ready for, understand the adhering to first: Although the concept is typically sold as such, you're not really taking a funding from on your own. If that were the instance, you would not need to repay it. Instead, you're obtaining from the insurance business and have to settle it with passion.

Some social media blog posts advise utilizing cash money worth from entire life insurance to pay for credit history card financial debt. The idea is that when you repay the finance with rate of interest, the quantity will certainly be returned to your financial investments. Unfortunately, that's not just how it functions. When you pay back the financing, a portion of that passion mosts likely to the insurance policy company.

What happens if I stop using Infinite Banking Wealth Strategy?

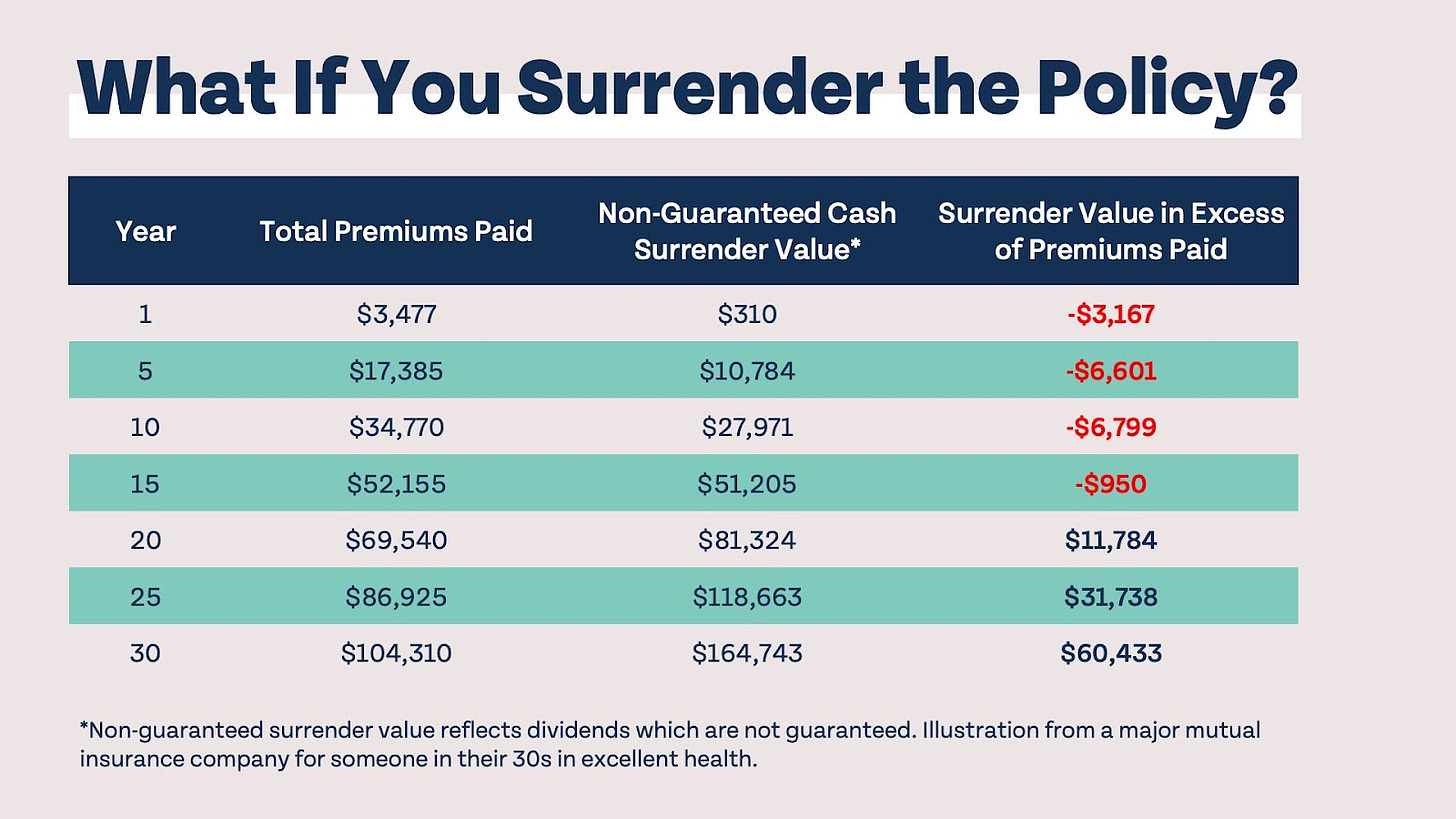

For the initial a number of years, you'll be repaying the payment. This makes it very challenging for your policy to build up value throughout this moment. Whole life insurance policy expenses 5 to 15 times a lot more than term insurance policy. Most individuals just can not afford it. So, unless you can pay for to pay a couple of to several hundred dollars for the next years or more, IBC won't help you.

Not everyone must rely solely on themselves for financial safety and security. Infinite Banking concept. If you call for life insurance, below are some valuable suggestions to consider: Think about term life insurance policy. These policies offer coverage during years with considerable monetary commitments, like mortgages, trainee finances, or when caring for young children. See to it to look around for the finest price.

What are the most successful uses of Infinite Banking For Financial Freedom?

Picture never ever needing to bother with small business loan or high rates of interest once more. What happens if you could borrow money on your terms and construct riches all at once? That's the power of boundless banking life insurance policy. By leveraging the cash money worth of entire life insurance policy IUL policies, you can expand your wealth and obtain cash without counting on conventional financial institutions.

There's no set funding term, and you have the flexibility to pick the repayment routine, which can be as leisurely as paying off the funding at the time of death. This adaptability encompasses the servicing of the finances, where you can choose interest-only repayments, maintaining the finance balance flat and convenient.

What is the minimum commitment for Infinite Banking Wealth Strategy?

Holding money in an IUL taken care of account being credited passion can usually be far better than holding the cash on down payment at a bank.: You have actually always dreamed of opening your own bakeshop. You can borrow from your IUL plan to cover the first expenditures of leasing an area, buying tools, and employing staff.

Individual fundings can be obtained from traditional financial institutions and lending institution. Right here are some key points to take into consideration. Credit scores cards can give a flexible way to borrow money for very temporary durations. Borrowing cash on a credit report card is typically extremely costly with yearly percentage rates of interest (APR) commonly reaching 20% to 30% or even more a year.

Table of Contents

Latest Posts

My Wallet Be Your Own Bank

Bank On Yourself Ripoff

Is Bank On Yourself Legitimate

More

Latest Posts

My Wallet Be Your Own Bank

Bank On Yourself Ripoff

Is Bank On Yourself Legitimate